20 Money Saving Tips For 20 Somethings

At what age did you really begin to start taking your personal finances seriously?

Introduction

Your 20's are crucial years for personal finance. Getting a head start as a young twenty something can make the difference between retiring early and living comfortably, or struggling toward a retirement that feels ages away.

When you are still in college or have barely moved out of your parents' house, a common belief is that you do not, or should not have to worry about money just yet. Most people believe that when you are young you are supposed to just have fun and then pay for it later. The smarter mindset is to start learning as much about personal finance now, so that when you are in your 30's and possibly married with children and other responsibilities you'll be able to live more comfortably knowing that you have a savings "nest" to rely on in the event of emergencies or slow times. Your 20's is the best time to save, because you really only have to worry about yourself for the most part.

I live life frugally and have picked up on certain tips that help me along the way, and I am sharing these tips and experiments with the hope that other young adults like myself will consider them useful.

1. Get Yer Learnin'

The average twenty-something knows little-to-nothing about personal finance and investing. Hopefully grade schools are catching onto this and considering bringing back classes that help better prepare teens for what it means to pay bills, how the stock market works, savings, etc.

Unfortunately, if you're like me and grew up in the 90's...you got nothin'.

I think the first time I learned how to write a check was in late high school. At that time, if you had asked me what a CD is, you would've received a blank stare and possibly a point in the direction of a pile of old N'Sync and Backstreet Boys discs in a corner.

You will only get the full benefits of saving and investing if you have somewhat of an understanding of how to deal with your money on your own. There are stock brokers and financial advisers to help you along the way, but there is only so much they can do for you. The sooner you start to learn, the better. So what are you waiting for?

2. Think Yourself Poor

This is a tried and true method that I have lived by all throughout college, and guess what? It works like a charm.

Here's how it works: Your friends all want to go out and see that new horror movie that you know will be terrible. You don't want to waste $10+ of your hard-earned cash to see a movie that you know you will regret paying for. So what do you say when they ask you?

"I'm sorry, I can't afford to go out to the movies right now..."

Voila! You've not only gotten yourself out of spending unnecessary money on something you didn't want to do, but you've also ducked out of watching that terrible movie altogether! The beauty of it is that people won't bother you about your money situation, because it's personal. So for the most part people will just leave you and your tiny bank account alone.

You can even trick yourself with this. Don't even look at your bank balance or your savings. Just think that you have less than $100 in your account at all times. If you keep telling yourself "I shouldn't, I can't afford it." Eventually you'll really think you can't afford it and you won't even think to buy it in the first place. I've saved so much using this method, it's ridiculous.

3. Use Cash Instead Of Plastic (An Experiment of Sorts)

Ever notice how careless you can be with your money when you pay with a debit card? Just one swipe and it's over. You barely notice the price because swiping a $1.13 purchase feels exactly the same as swiping a $60.13 purchase.

If you had made those same purchases with cash however, you'd definitely feel the difference between taking out a couple of $1 bills versus kissing a few $20 bills goodbye. Don't always rely on your bank card for purchases and you'll start to become more aware of how much you're really throwing away.

**Obviously, it is not recommended to carry large sums of cash with you. This is more of an experiment for the everyday purchases that are so common, you don't realize how quickly they add up.

4. Learn To Coupon

Thanks to couponing, I haven't spent more than 50 cents on toothpaste in years. Using coupons isn't anything new, but the new craze better known as extreme couponing is definitely a fad that is worth getting into. You don't have to be extreme to save big. My couponing methods involves less than an hour of effort spent every once in a while and one or less trips to my favorite store. If there isn't an amazing deal, I won't bother to go. If there is an amazing deal (which there often is) I save between $20 and $50 and only spend $5 or less out of pocket on products that I know I will use.

Coupons are a way to almost cheat system on brand name items and spend cents on otherwise expensive items. Bottom line: learn to coupon, and let it become a part of your financial routine.

5. Reward Yourself From Time To Time

Just like dieting, you should always allow yourself to be rewarded when you've done well. Stay on track for a month straight, and then reward yourself with fun at a discounted price. Check your area for local discount theaters, shop the sales at the mall, or buy a deal from a site like Groupon or Living Social. These types of sites allow you to save up to 90% on businesses in your area, including restaurants, spas, events, and more. If you vow only to use deal sites for dining out or going to the salon, you'll never have to pay full price again. Ever.

6. Punish Yourself For Overspending

While most people choose the reward method to encourage smart-spending, I like to go for the latter approach sometimes. Lately I have been trying to keep a better hold on my unnecessary spending each weekday. If you want to save more, try my method out instead:

Every time you make a purchase that isn't a necessity (gas, bills, groceries), write the amount you spent that day down. At the end of the week, count up how much you have spent on useless things and places, match the amount, and transfer it to your savings account. If I spent $30 on dining out and junk food at work during the week, that Sunday I would transfer $30 to my savings. This way I am forced to look at what I'm wasting my money on, and I have to pay for it.

7. Create A Budget

If you haven't done this already, you need to create a generalized budget. Write down all of the things that you have to pay for each month (bills, student loans, groceries, gym memberships). Categorize them into necessary and unnecessary. Use pictures if you have to. Whatever helps you get an overall look at your monthly expenses in a way that is most understandable. Then, figure out your average monthly income. How much money do you have left to put towards your future? Is there anything that you can begin cutting costs on?

8. Now Track Your Budget

After you've created your generalized budget, keep a copy of it with a budget journal. Online banking services are great for tracking all of your transactions, but there is something more real feeling about writing your purchases down on paper. Keep track of everything you spend money on, keep receipts in your journal, and highlight purchases into separate categories. Getting a better visual on all of your money habits will help you see room for improvement. Plus you'll feel great after having an entire day without a single mark of the pen!

9. Stick To Your Budget Using Envelopes

This is a unique idea people have used to stick to your budget, no matter what. First, plan your generalized budget. Then, take out the money you will need for all of your categories and organize it into an envelope for each category. If you only want to allow yourself to spend $200/month on groceries, put $200 in an envelope labeled "groceries". If your monthly cable bill is $80/month, put $80 into an envelope labeled "cable bill", and so on. This may sound silly, but it's a way to guarantee you aren't going to disobey your budget plan. Don't forget to make a small envelope labeled "fun" as well.

10. Save Dollars With Certain Letters On Them

This is another unique idea that I've found people using. Look at the front of a dollar bill. To the top left of the bill, you'll see a letter and a series of numbers. A fun way to save is to vow to save every bill with a certain letter on it, no matter what. You can choose a letter than stands for something, like "C" for "Car", or save bills with whatever letter is the beginning of your first name. Keep an eye out for the bills with your special letter and save them, even if it's $100.

11. Pack Your Lunch, Cook Your Dinner

Twenty somethings today weren't as likely to have had to cook when they were younger. Therefore what we are left with are a bunch of terrible cooks who would rather spend a little extra cash to avoid the stove. My advice: Get cookin'.

It's no secret that packing your own lunch and cooking dinners that don't come in a microwavable tray are two easy ways to cut down on huge costs, but so many people still do it! It seems harmless if you think of it in one purchase.

Dining out and pre-made dinners are your enemy. They not only hurt your wallet, but the excess calories you'll consume will come back to get you as well. Keep restaurants to a minimum, or use them as rewards for smarter spending.

A Little Literature To Help You Get Started...

12. Have A Drink Before Going Out

Although "pre-gaming" is something that underage teens do before going out so that they can party like a 21 year old, there's a lot to be said for saving money from avoiding a bar tab by starting at home.

One of the biggest issues I run into when trying to save money is the fact that I'm still in my lower 20's and all of my friends still want to "go out" every weekend. Going out may be fine if you're still living at home and your parents still pay for everything, but when you're trying to save what little extra you have, wasting $30 to get a slight buzz at a local bar just doesn't seem very appealing. For what you pay to drink out at a club or bar you could buy over twice as much if you had bought something in a store and drank at home. Also, due to the affects of alcohol you're more likely to be careless about your spending while you're out. One little drink could turn into a round bought for your friends and an overly-generous tip to the bartender who you thought resembled Ashton Kutcher at the time.

If you've already got a ride to the bar, have a drink or two at home and then get cash out at an atm. Set a maximum for how much you plan to spend (including the tip) and stick to it. You'll save at least $20 each time, and depending on how many times you go out per month you should see a big difference in savings.

13. Avoid Brand New Furniture And Appliances

We've already spoken about how terrible the average 20 something is at cooking. Don't buy a brand new $200 pan set. It may be really fancy and look amazing, but you'll probably ruin it. Chances are if you are just starting out your life as an adult, you're going to be doing a lot of moving. Since I have graduated from High School I've lived in 3 different apartments, 2 different "homes" to return to on college breaks, and a new house. If my couch had been brand new when I bought it, I would have made a huge mistake. During moves, furniture gets damaged. In college, furniture gets damaged. My old couch had permanent marks from squeezing it through 5 different doorways and stains from other furniture laying atop it in the moving truck.

Accumulate used furniture and appliances from family members, thrift stores, and garage sales, and save the good stuff for when you're finally settled into your first house. Plus, haven't you noticed that shabby chic is in right now? If you had bought new everything, you'd probably have to buy new everything all over again regardless, so why not spend little-to-nothing the first time around?

14. Get A Dumb Phone

You don't need a data plan. Let me repeat that. You don't need a data plan. Unless you own your own business or it is an absolute necessity to have access to the internet from any area, you don' t need a data plan. You can save $30+/month to wait until you get home to get on Facebook. That's over $360 each year that you've wasted so that you can post on Instagram to all of your friends that you're at Outback Steakhouse with your best friend.

Obviously there are plans that don't require an additional $30+ to get a data plan added, but for most cell phone providers, you will see an extra fee. It adds up, and it's completely useless to most.

15. Buy A Used Car

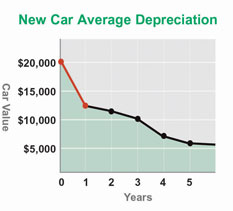

The Millionaire Next Door states that most millionaires drive older or used automobiles. One of the biggest mistakes young adults make is buying a brand new car as soon as they nail their first salary job. By buying a new car, you are chaining yourself to endless months of car payments, not to mention higher insurance. They say that as soon as you drive a new car out of the lot it begins to lose its value, and it's true.

Find a used car that is new enough that you can get respect for yourself without having to make expensive payments every month. You'll thank yourself later.

16. Sell Your Old Belongings

Your early 20's are a perfect time to sort through old things, and make a profit from it. Auction sites like Ebay are a great way to earn some easy cash from unwanted belongings. Not feeling savvy enough? Throw a good old fashioned garage sale. Not only will you clear out and organize unwanted things, you'll be paid to do it.

17. Put Money Aside For A Big Splurge

Ok, there's something that you've been dying to buy, but it's a little pricey. You have the money in your savings, so you technically could go buy it today. Stop! Don't do it! Remember...good things come to those who wait.

If you want something expensive and you can't wait until a holiday to get it, withdraw a fixed amount from each weekly paycheck until you can afford it. My husband and I once pitched in to buy an iPad to share as a large Valentine's Day gift. Every week I withdraw $50 from my paycheck and put the cash in an envelope labeled "iPad."

Forcing yourself to save little by little even if you can afford it in the first place makes your large purchase even more rewarding when you finally can go out and buy it. It's also useful to have this purchase in the back of your mind to fend off other splurges because you will always be thinking "ahh but I shouldn't, not while I'm still saving up for that iPad".

Another plus to waiting? If I had bought the iPad weeks earlier, I would have missed out on a big upgrade. Apple was releasing the iPad 3 right around the same time (2012-ish?) I'd have saved up enough to buy one. To think I almost bought an iPad 2 right away and would have missed out on all of the new features...

18. Avoid Expensive Grocery Stores

If you aren't couponing, the least thing you could do is go to a cheaper grocery store. You don't have to buy every single food item brand name. Flour, sugar, milk, butter, etc. doesn't need to be brand name. If there is anything that you really can't taste a difference in, why would you spend extra to get a fancy label slapped on it? You can cut your grocery bill in half just by buying store brand products and buying in bulk when possible. You can cut your grocery bill down by two-thirds if you shop at a store like Aldi.

Just think of how short your time with food is. You eat it and then it's gone. Why would you waste so much money on something that is gone in 5 minutes? Why not save that money, and put it towards something that you can keep and use over and over? Or save that money to spend a special evening out with friends that will leave you with a memory that lasts longer than those donuts ever did.

If you are strictly shopping organic, that's another story. There really isn't a lot you can do to save on organic groceries. The best you could do is hope for a store like Trader Joes, buy seasonal produce, and hit up organic farmers markets whenever possible.

19. Buy Gifts On Off Seasons, Then Save Them

This method isn't new, but it's definitely something to keep in mind. When sales are at their best, that should be when you're buying gifts, regardless of how close the actual birthdays or holidays are. Not only can you get more for less, but you don't have to worry about dipping into your savings during holiday crunch times. Christmas definitely got me this year, so this time around I'm getting a head start and storing gifts for later use.

Time to Confess!

How much would you say you spend per workday for coffee/breakfast at the drive thru?

20. Make Your Own Coffee

In my earlier 20's I was working a desk job at a local advertising company. The best part of my day (sadly) was the trip to Dunkin Donuts I would take with my coworkers on our breaks. I'd get a small iced mocha for $2.16 (this was around 2012) nearly every work day and I wouldn't feel guilty because I "earned" it. Right? Wrong.

After several months of foolishly purchasing one iced mocha after the next, I decided to do a little simple math. $2.16 x 5 work days = $10.80/wk. With an average of 4 weeks/month that totals $43.20/mo. and $518.40 per year for coffee.

Ok. Dunkin is good, but it's not that good! Was I absolutely nuts? How many Americans spend a couple bucks on coffee every work day? Not only that, but they might be a coffee for their coworker or throw in a bagel or breakfast wrap. How much of your money is being thrown away with those coffee grounds?

Conclusion

With these easy-to-follow steps, you should start seeing a big difference in your savings right away. Being financially stable isn't just taking a few steps every once in awhile to save a buck though. It involves a complete change in lifestyle. If you enjoy living the high life and care too much about appearing wealthy, you will probably never actually be wealthy and you will find it hard to follow these simple steps. If you are used to living a low maintenance life and care about financial responsibility, you'll find that these steps are an easy addition to your daily routine.

The most important thing to keep in mind is that sooner is better. You are never too penniless to start saving towards your future, and hopefully with these tips you are on a better foot to get started.